Unexpected Costs When Starting a Business (and How to Plan for Them)

Written by Lisa M. Masiello

What every small business owner must know about the hidden costs of starting a business.

Most new business owners struggle to determine how much money they need to start and grow their business. While there’s no shortage of startup advice online, most of it skips over the unglamorous side of building a business. These parts don’t fit into a quick checklist or go viral on social media, but they’re critically important.

Consider this.

Just over one in five U.S. small businesses (21.5%) close within their first 12 months, according to Bureau of Labor Statistics data on private-sector establishments.

Source: LendingTree analysis of Bureau of Labor Statistics (April 2025)

Product inventory, marketing programs, and physical office space are some of the most frequently included checklist items. What about legal filings, cybersecurity, and employee expenses? These overlooked hidden costs can quickly reduce your available funds and bottom line.

You must be aware of hidden fees and include them in your initial budgeting process. Knowing these fees prevents you from being caught off guard.

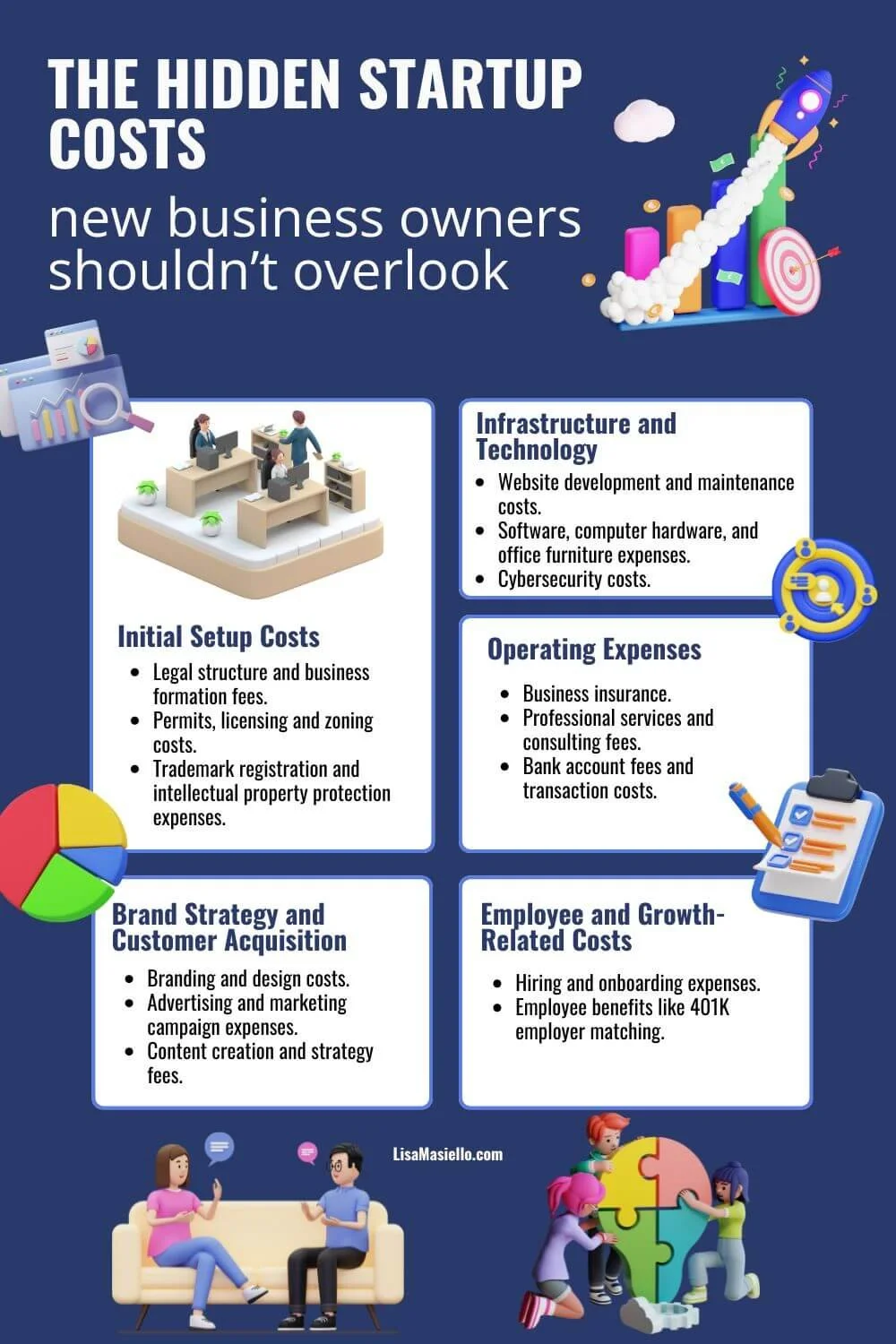

This post addresses setup costs, infrastructure and technology, operating expenses, brand marketing, customer acquisition, and additional employee overhead.

Initial setup costs.

When building a house, your first step is to construct a solid and secure foundation. That will help ensure your house stands strong. This analogy is also valid for starting a business. You must build your foundation before selling your products or services.

While focusing on selecting the business name and building the website, have you considered registering your business with the government? What legal entity will it be, and are there any permits or licenses you may need?

These setup expenses cannot be avoided. Failing to address them can cause launch delays, legal issues, and potential fines.

1. Legal structure and business formation fees.

Selecting the appropriate legal structure for your business is critical. There are so many options that it can be overwhelming. Unfortunately, you can't brush this decision aside. A sole proprietorship, LLC, partnership, corporation, or s-corporation each has legal and tax implications. And they each have their own registration fees and costs, like drafting incorporation documents and acquiring an Employer Identification Number (EIN).

State filing fees.

You must register your business with the state where you will operate. There is a filing fee associated with this. The cost will vary based on the state and the type of business entity you choose. An LLC, for example, may cost you as little as $50 or $100 in some states, while it could be $500 or more in others.

Annual report fees.

Many businesses are required to file an annual report. As the name implies, you must file annually, and there is a fee to maintain your entity as a "business in good standing." Failure to submit an annual report and pay the fee by its due date can result in penalties.

Registered agent fees.

A registered agent is required and must be named by you when completing the initial business formation documents. A registered agent is a person or entity that acts as the business' point of contact to receive legal notices, official communication from your state, and communication from state and Federal tax agencies. If you do not register yourself and your address as the registered agent, you may need to hire a registered agent, which will be an additional cost.

2. Permits. Licenses. Zoning.

Depending on your business type, industry, and location, you may be required to get specific licenses or permits. For example, if you are opening a restaurant or other food-related business, you will most likely be required to obtain a food license and a public health permit. You will need a professional license if you are a plumber or electrician. If you plan to open a physical location in your town, you may need a zoning permit to alter the space to suit your requirements.

General business licenses.

A general business license is a permit allowing a business in any industry to operate in a specific location. Not all local or state governments require this license. Still, setting aside funds until you determine whether this is needed in your area is a good idea.

Business permits.

Like the food service industry, other industries, such as childcare and healthcare, may require you to pay for additional permits related to your specific area of focus.

Zoning permits.

A zoning permit may apply if you sell your products and services from a physical, brick-and-mortar location and want to renovate or modify the space.

3. Trademark registration. Intellectual property protection.

While protecting your brand and intellectual property is not required to start a business, it is an important consideration. By safeguarding your unique identity, you can prevent competitors from copying your ideas, establish a strong market position, and increase your chances for success. Consider patents, trademarks, and copyrights if developing a highly unique product or service.

Trademark registration.

While trademarking your brand's name or logo is not required, you may consider using trademark registration to protect specific aspects of your business from usage violations by others.

Patents. Copyrights.

If, for example, you are an inventor developing something no one has ever created or an author writing unique content, you may choose to register a patent or copyright. Applying for a patent, in particular, can be lengthy and costly.

Infrastructure and technology.

Technology is the backbone of every modern business. From buying your first laptop to building your website and securing your customers' credit card information, new business owners often underestimate the ongoing investments required to keep things running smoothly and ensure the business is well-equipped for current business needs but can quickly transform as future needs change.

1. Website development. Website maintenance.

There is no question that today's businesses need a website. You can't survive without one. It is the first place a potential customer goes to learn everything about you. If this is your first time building a website, you may not know all the hidden costs beyond the initial site development.

Once your site is up and running, you will incur ongoing maintenance costs to keep it secure, up-to-date, and working well. These include website hosting fees, domain name renewal fees, and regular updates and security patch costs.

Buy a domain. Domain management.

Before building your website, you must buy a domain name from a company like GoDaddy, Squarespace, or others. This fee is typically annual and can vary based on the domain's popularity and extension.

Website builder. Hosting.

How will you build your website, and where will you host it? You will likely not purchase your server and host it yourself. You will likely use the services of a company like WordPress, GoDaddy, Squarespace, Shopify, or others. Considerations include whether you will sell products and services directly on the site, the amount of traffic you generate, data storage needs, and security features you require. These all cost money.

SSL certificates.

Ensure your website is secure with a Secure Sockets Layer certificate, better known as an SSL certificate. This digital file encrypts data between your website and visitors' browsers. Savvy website visitors know to look for the lock icon in their web browser's address bar, which tells them the site is using an SSL certificate. This not only helps them feel safe but also builds trust in your business. Some hosting providers offer a basic SSL for free, but premium options can cost extra.

Remember that these are not one-time expenses. Ongoing costs are typical for things like next-generation software, updating plugins, receiving technical support, and performing security audits.

2. Software. SaaS. Subscriptions.

Today's software is sold primarily through a monthly or yearly subscription fee. This type of service is known as SaaS – Software as a Service – and is now the most widely used means of accessing and using what used to be sold in a box off a shelf. Every department, including sales, marketing, accounting, and customer service, relies on particular software to do their jobs. The costs for each of these tools can quickly add up. It's essential to budget for these recurring costs and consider the potential need for additional software as your business grows.

Accounting software.

Accurately managing your finances requires QuickBooks, FreshBooks, or a similar tool. Because they are cloud-based SaaS software, they each come with a subscription fee that will vary depending on your chosen plan.

CRM software.

Understanding your customers' actions requires Customer Relationship Management (CRM) software like HubSpot or Salesforce. These software programs help you better manage your customer interactions and target your messaging and sales efforts, but they come with a cost.

Marketing tools.

Email marketing platforms like Mailchimp and Constant Contact, social media scheduling tools like CoSchedule and Post Planner, and SEO software like SEMrush and Ahrefs are valuable tools to get the most out of your marketing strategy and build an effective and efficient online presence.

3. Computer hardware. Office furniture.

Even if you're running a home-based or online business, you must pay for basic office furniture, equipment, and other resources. Do you have desks, chairs, and storage solutions reserved for business use? What about the computer equipment to run your business? These costs can add up quickly whether you are a solopreneur or equipping an office of six people.

Desktops and laptops.

You'll need a reliable computer or laptop built for business use. A high-quality device can be expensive, so budget for the initial purchase and future upgrades.

Office furniture.

You may start your business at your kitchen table or in a small office with a folding chair, but you'll quickly discover that ergonomic chairs, desks, and other office furniture benefit productivity and comfort.

Printers and accessories.

You may have included an office printer in your list of expenses, but have you included the ink, paper, and printer maintenance? While they may seem insignificant initially, they can add up over time.

4. Information security. Cybersecurity measures.

Protecting your business data and customer information is more critical than ever. Cyber-attacks don't just happen to the biggest corporations. They happen to small businesses as well. Hackers know that large corporations are more likely to have advanced security measures in place. At the same time, small companies may have limited or no security measures in place. Security can start with common antivirus software and advance to firewalls, encryption tools, and regularly scheduled audits. In addition to the technology, consider investing in employee training. This helps ensure your team knows the best practices for maintaining a sound cybersecurity strategy.

Firewalls. Antivirus software.

These are critical for preventing malware from negatively affecting your desktops, laptops, and tablets and protecting your important documents.

Data backup.

Cloud-based data backup services ensure you can recover from hardware failure, a cyberattack, and other kinds of data loss. While you may have already included general IT support in your budget, data backup is usually a separate service that a managed service provider offers at an additional cost.

Tips for managing startup costs.

Budget early: Planning for hidden expenses in advance minimizes financial surprises.

Research: Knowing your industry-specific fees and regulations will help in accurate budgeting.

Prioritize wisely: Focus on essential expenditures first, then expand as your business grows.

OPEX or operating expenses.

Once you launch your business, hidden fees don't disappear. Day-to-day business operations come with a whole new set of hidden expenses. Think beyond the obvious things like rent and utilities. Have you considered business insurance, professional services, and banking fees? These are critical to ensuring your business runs smoothly as it grows.

1. Business insurance.

Insurance is one of the most commonly overlooked costs, yet it's critical for protecting your business from potential liabilities. Depending on your industry and type of business, you may need different types of insurance, like general liability, professional liability, property insurance, and workers' compensation. The costs of these policies vary based on factors like the size of your business, the number of employees, and the level of coverage required.

General liability insurance.

General liability insurance protects your business from financial loss. Claims related to this type of insurance include bodily injury, property damage, personal injury, false or misleading advertising, and more.

Professional liability insurance.

Especially important for service-based businesses, professional liability insurance covers your legal defense costs if you are sued for professional mistakes or negligence, such as inaccurate advice, breach of contract, missed deadlines, and undelivered services.

Workers' compensation insurance.

Most states require you to purchase workers' compensation insurance for your employees. Be sure to check the requirements in your state.

2. Professional services. Business consultants. (accountants, lawyers, etc.)

No first-time owner knows everything about their business. You may be an expert marketeer but don't know the ins and outs of finance.

You may know precisely how to build a new sales team but don't have the time to focus on all aspects of the hiring process.

Hiring professionals to take over the areas of expertise you don't possess or take over responsibilities you don't have time for will help the business run more smoothly, avoid legal hazards, and save you time. This will also save you money in the long run but costs money upfront.

Accountants and bookkeepers.

While you may have a great understanding of accounting practices and financial matters, you may not have the time to create and send invoices to customers, pay employees, or prepare tax documents. Paying an accountant or bookkeeper will cost you money. Still, it will free you up to focus on other, more strategic business areas that will result in more significant growth.

Legal and other freelance services.

As a small business, you don't need to hire an attorney as a full-time employee. Engaging a freelance attorney for specific tasks or projects like drafting a contract, registering a trademark, or resolving a customer dispute will cost money but is significantly less expensive than having ongoing, full-time legal representation and paying for them when you have nothing for them to work on.

3. Bank account fee. Transaction costs.

We all know the banking fees heaped upon us as private citizens. These fees also exist for business bank accounts, and they can eat away at your profits if you're not careful. Monthly account maintenance fees, transaction fees for credit card processing, and fees for wire transfers are just the beginning. When evaluating a bank's business services, understand their charges and shop for the bank that offers the best value for you.

Credit card processing fees.

If you accept credit card payments, expect to pay a processing fee of between one and a half and three percent for each transaction.

Bank account fees.

Besides the monthly maintenance fee that some banks charge, find out if they require you to maintain a minimum account balance to avoid extra charges. Most banks do.

Brand strategy. Customer acquisition.

Your ultimate goal is to attract potential buyers and turn them into customers. While you may know to budget for things like social media ads or email marketing, many other hidden costs are associated with building your brand and reaching your target audience before you've even opened your doors.

Even if you are already an expert marketer and can design your business cards and brochures, write online content, and build your website, remember, as a business owner, you have 1,001 responsibilities and only 24 hours in the day. While you may be able to do these things yourself, do you have the time, and does doing these things yourself make the best use of your time? Paying for these services may free you up to complete more critical things.

1. Branding and design costs.

Building a solid brand identity helps attract and retain the customers you want. This involves costs for logo design, business cards, product packaging, brochures, signage, etc.

Logo design.

While you can use a DIY tool like Canva to create a logo, hiring a professional designer can produce a higher-quality design. But it also comes with a higher price. Either way, remember to include money for branding services.

Business cards, brochures, and signage.

The costs for physical marketing materials like company brochures and business cards may seem small, but they can add up, especially when you combine design costs with printing.

2. Advertising and marketing campaigns.

Running PPC (pay-per-click) ads on search engines and social media platforms can increase website traffic. Still, you should pay attention to how much you need to invest to see a good return on investment (ROI). You may also need to budget for marketing tools, platforms, and subscription applications that help you manage and track your campaigns.

Social media ads.

Facebook, Instagram, and LinkedIn are examples of social media platforms where advertising can be effective. However, depending on your targeting options, it can become costly.

Search engine marketing (SEM).

Pay-per-click (PPC) campaigns on Google can drive increased traffic to your website, but remember, each click costs money.

3. Content creation and strategy.

Content marketing is a powerful way to attract potential customers, build brand authority, and add value. Still, high-quality content (not AI-generated) requires time and financial investment. Writing blog posts and creating videos, infographics, and social media posts may require hiring writers, designers, and videographers and investing in software and online content management and distribution platforms.

Hiring copywriters or graphic designers.

Outsourcing can be expensive if you're not writing content or designing social media posts yourself.

SEO tools.

Effectively optimizing your content for search engines requires analyzing data using tools like SEMrush or Ahrefs, which have monthly subscription fees.

Employee and growth-related costs.

As your business grows, so do your expenses—particularly when hiring and retaining employees. Whether you're onboarding your first employee or expanding your team, the costs associated with recruitment, training, and benefits can quickly become significant. Scaling your business may also require new systems, software, and physical space.

1. Hiring and onboarding.

The costs associated with hiring even one employee can include job advertising, recruitment agency fees, and background checks. Additionally, onboarding new employees requires training and providing them with the necessary tools and resources to do their jobs effectively. Beyond the regular salary, consider these other expenses.

Recruitment costs.

Recruitment costs can increase even if you post simple help-wanted ads on an online job site like Indeed or ZipRecruiter.

Onboarding and training.

The time and resources needed to onboard new employees can be significant, especially if you purchase additional equipment or software licenses.

2. Employee benefits.

Offering highly sought-after benefits is a great way to attract and retain employees. However, offering health insurance, retirement plans, and paid time off can be unrealistic for many small businesses just starting. The costs can add up. Still, it's crucial to weigh the benefits and drawbacks of incurring the cash outlay to offer these benefits vs. the ability to attract top talent to your business.

Health insurance.

While most small businesses are not legally required to provide health insurance to their employees, hiring employees who will stay with you for a long time is undoubtedly an advantage.

Retirement benefits.

Offering a 401(k) or another retirement plan is increasingly common, but it's no longer enough of an incentive to have a potential employee select your job over another. These potential employees look more closely at businesses that include an employer match or contribution as part of the plan.

Budgeting for the long term.

Startup costs extend far beyond the expenses we can all think of off the top of our heads. I hope you now see why planning for these hidden costs of starting a business is so critical. You'll be better equipped to manage your finances, avoid costly surprises, and achieve long-term success. Remember, anticipating, understanding, and effectively budgeting for these hidden costs can enable you to not just survive during your first few years of operation but thrive.

I wish you great success!

Other related posts

Filter by Category

About Lisa M. Masiello

Lisa M. Masiello is a business owner, author, and coach who equips new and aspiring business owners with practical tools and clear knowledge to break free from the stuck phase and make real progress. With over three decades of experience guiding fast-growing startups and large corporations in their marketing strategy, she knows what it takes to build momentum and deliver results.